22 April 2024 | Weekly Snapshot

Saward Dawson > Wealth Advisory Insights > Weekly Snapshot > 22 April 2024

Did you know?

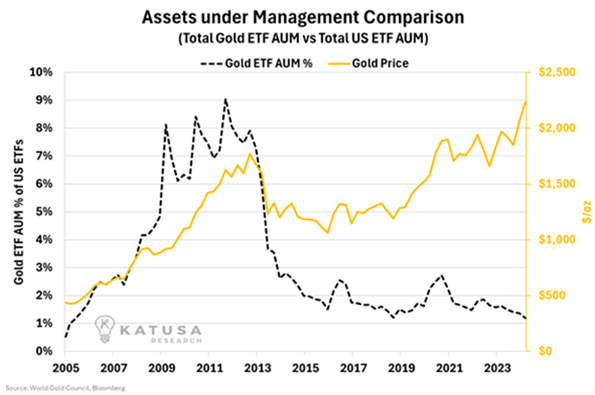

Despite a huge rally in gold prices to record levels, investors have, by-and-large, missed out on those gains. This is represented by the below chart, which shows the gold price (gold line) vs investor flow-of-funds into Gold (black line), which has remained low at around 1%.

Market Movements

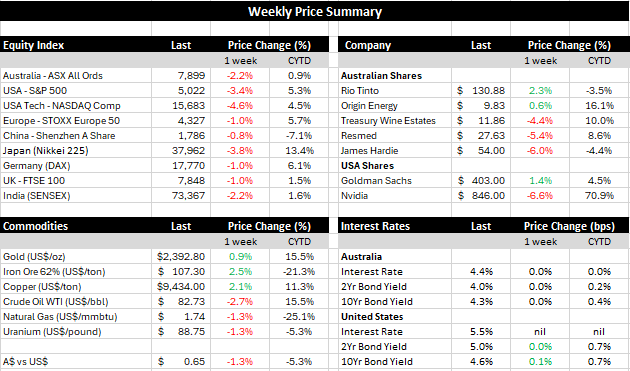

The Australian market fell 2% along with all other equity markets this week.

US retail sales came in stronger than expected on Monday, up 0.7% for the month (vs 0.3% expected and 0.9% in the prior month). This helped to push bond yields higher, whilst also lowering the short-term prospects for interest rate cuts. 5-Year government bonds were trading at 4.7%, which is above the level when Silicon Valley Bank got into trouble (Mar-2023). The stronger bond yields explain why growth sectors, such as the Nasdaq, were the hardest hit this week (Nasdaq index down 4.6%). ‘Market-darling’ Nvidia was also down 17%. Nvidia suffered on the back of reports from one of their largest customers, Microsoft, who announced their intentions to invest US$100b into a new data centre, which might not feature any Nvidia hardware. The new data centre will be operational by 2028.

Conflict in the middle east created some market nervousness. Parties are communicating their threats and strategies ahead of time, indicating to markets that conflict might be short lived. Gold was up 0.9% for the week and has risen 15% this year. Gold-miners were mixed, Newmont was flat for the week, whilst Northern Star was up 2%

Base metals also saw gains after the US and UK announced trading bans on Russian production on the London Metals Exchange (LME) across aluminium, copper and nickel. Russia accounted for 91% of LME aluminium stocks, 62% of copper and 36% of nickel at end of March. Copper was up 2.1% for the week. Rio Tinto led the miners, up 2.3% this week, whilst BHP was down 4%.

ResMed (RMD) finished down 4% for the week. Belying this modest fall were some important study results from Eli Lilly (US-listed mega-cap) and their weight loss drug, GLP-1. Study results showed that when patients took the weight loss drugs, apnea levels reduced by approx. 60%. This has implications for RMD because they have sales of over $6b from their CPAP-mask, which treats patients who suffer from sleep-apnea.

Portfolio Movements

Bank of America reports solid Q1 results

- Bank of America reported solid Q1 results last week with Q1 earnings of $0.83 ahead of the $0.76 expected. Q1 revenue of $25.82B was also ahead of the $25.49B expected.

- Net interest margins were stronger but loan volumes were modestly below expectations

- Shares finished up 3% for the week.

Johnson and Johnson (J&J) beat Q1 earnings estimates – Full year guidance on the soft side

- J&J reported Q1 earnings of $2.71, ahead of the $2.64 estimate. Q1 revenue of $21.38B was in line.

- Full year guidance for earnings per share in the $10.57 – $10.72 range, largely in line with the previous guidance of $10.55 – $10.75.

- The share price fell 2% on the results but finished flat for the week.

ASML beats Q1 estimates – Q2 guidance misses

- Advanced chip manufacturer ASML reported solid Q1 results but lowered their Q2 guidance. Q1 EPS of €3.11 was ahead of the €2.91 expected. And a strong gross margin of 51.0% was well ahead of the 49.4% expected.

- However, the Q2 guidance for revenue in the €5.7B-€6.2B range was a decent miss in the consensus midpoint of €6.39B.

- The Dutch group said they are seeing a lull in demand for its most advanced machines but is gearing up for a strong 2025 due to demand for AI and memory chips, including from top customer TSMC of Taiwan which makes chips for Nvidia and Apple.

The Week Ahead

- Tuesday: Global Manufacturing PMI readings will be announced. The previous month showed modest growth (reading of 51.9). A strong reading suggests stronger profitability from broader sections of the economy, including industrials and manufacturing. Busy day in the US quarterly reporting calendar with Tesla (consensus earnings US$0.49/share), Visa (consensus US$2.44/share) and copper giant Freeport McMoran (consensus US$0.27/share) all reporting results.

- Wednesday: Australia inflation, quarterly. Previous quarter was a 0.6% increase. Meta also reports quarterly results, consensus earnings per share of US$4.31.

- Thursday: US mega caps Microsoft and Alphabet report quarterly earnings (consensus US$2.81 and US$1.51 respectively)

Saward Dawson Wealth Advisors Pty Ltd, a Corporate Authorised Representative of Akambo Pty Ltd t/a Accountants Private Advice

The information presented in this publication is general information only, and is not intended to be financial product advice. It has not been prepared taking into account your investment objectives, financial situation or needs, and should not be used as the basis for making an investment decision. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and financial circumstances.

Some numerical figures in this publication have been subject to rounding adjustments. Akambo Pty Ltd (including any of its directors, officers or employees) will not accept liability for any loss or damage as a result of any reliance on this information. The market commentary reflect Akambo Pty Ltd’s views and beliefs at the time of preparation, which are subject to change without notice.