Saward Dawson > Wealth Advisory Insights > Weekly Snapshot > 15 April 2024

Did you know?

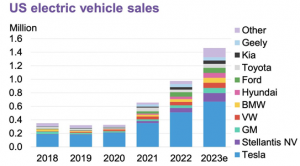

Tesla has dominated the electric vehicle market in the USA, but now the competition is starting to catch up.

Market Movements

The Australian market was basically flat this week. US shares were 1% higher, whilst US tech shares (Nasdaq) were 2.5% higher. Europe (-1%) and China (-2.6%) were both down.

US inflation data came in stronger than expected for the month of March (0.4% actual vs 0.3% expected). This prompted a strong move in bonds, where the yield on a 10Yr US government bond went from 4.3% to 4.6%. This comes on top of the stronger employment numbers from last Friday, where the US unemployment rate fell from 3.9% to 3.8%. Taken together, markets are now reducing their expectations for rate cuts for the remainder of 2024 from 3 rate cuts to 1.6 cuts.

In Australia, Computershare was up 7.9%. Their earnings are leveraged to the level of interest rates on bonds, which moved higher this week. Resources were strong again (Newmont up 5.9%, and Rio Tinto up 5.5%), helped by rising commodity prices. Listed property stocks were weaker by 1.7% (Mirvac down 3.7%). Health stocks were also soft, led by Sonic Healthcare (down 5.5%).

In the USA, Alphabet (Google) was strong, up 5.8% on no news. Consensus earnings expectations for Alphabet are for 31% growth over the coming 12 months, which is very strong. Alphabet is potentially looking cheap based on a price earnings ratio of 22 x earnings. The tech sector was the strongest sector despite the sensitivity of their valuations to higher bond yields. Morgan Stanley was down 5.9% after announcing that the regulators are looking into their Wealth unit, which generates approx. half of their revenue.

Portfolio Movements

Apple up 5% on Friday, their strongest day this year

- Apple shares had their strongest up day of the year on Friday, gaining 5%. They are still down 7% for the year, however. Drivers of this broader negativity include adverse trends in Chinese iPhone sales as well as anti-trust / competition issues around their data services business.

- CEO Tim Cook recently told investors to expect an AI announcement later this year. Apple is reportedly upgrading their computers with next-generation “M4 chips” that emphasize AI.

Palo Alto Networks and Google Cloud expand partnership

- Palo Alto has extended and increased its commitment to Google Cloud with a ten-figure, multi-year commitment and named Google Cloud its AI and infrastructure provider of choice.

- Google Cloud has long considered Palo Alto Networks its preferred ‘next generation’ firewall (NGFW) provider.

Intel unveils latest AI chip to compete with Nvidia

- Intel unveiled its latest artificial intelligence chip called ‘Gaudi 3’, which, according to Intel uses half the electricity and runs 1.5x faster than Nvidia’s H100 GPU.

- Intel said that the new Gaudi 3 chips would be available to customers in Q3 and didn’t provide a price range but said they “do expect it to be highly competitive” with Nvidia’s latest chips.

- Intel is looking to take market share from current leader Nvidia which has an estimated 80% of the AI chip market with its graphics processors, known as GPUs, which have been the high-end chip of choice for AI builders over the past year.

The Week Ahead

- Monday: USA, monthly retail sales (seasonally adjusted). Expectations for a 0.35% increase (0.6% prior month-to-month increase). Quarterly reporting season in the USA is getting underway, including Goldman Sachs on 15th April. The consensus earnings growth for the S&P500 is >20% for the coming 12 months, which is historically very strong. The trial between Donald Trump and Stormy Daniels will also re-commence. Trump will argue that he has not falsified documents (on 34 counts) to facilitate payments to the adult actress.

- Tuesday: USA, Industrial Production, monthly: Expectations for 0.4% increase (prior month 0.1%). The IMF will also provide an economic outlook. In Greece, the Olympic flame will be lit before starting its journey to Paris. LVMH (Louis Vuitton) will report Q1 sales, which will give helpful insight into the performance across high end consumer spending.

- Thursday: USA, Initial Jobless Claims, monthly: Prior month 211,000

- Friday: Indian elections begin, where Modi looks set to secure another 5-year term.

Saward Dawson Wealth Advisors Pty Ltd, a Corporate Authorised Representative of Akambo Pty Ltd t/a Accountants Private Advice

The information presented in this publication is general information only, and is not intended to be financial product advice. It has not been prepared taking into account your investment objectives, financial situation or needs, and should not be used as the basis for making an investment decision. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and financial circumstances.

Some numerical figures in this publication have been subject to rounding adjustments. Akambo Pty Ltd (including any of its directors, officers or employees) will not accept liability for any loss or damage as a result of any reliance on this information. The market commentary reflect Akambo Pty Ltd’s views and beliefs at the time of preparation, which are subject to change without notice.